All That Glitters

Interestingly, gold has been in the headlines more than usual this past week.

Fort Knox

A conspiracy theory that there’s no gold left in Fort Knox has been making the rounds.

I’ve written about conspiracy theories in the past. In the absence of credible information, it’s easy for imaginations to run wild.

Most of those modern conspiracy theories have come true. I’m hoping that this one won’t be true as it would be devastating to the country.

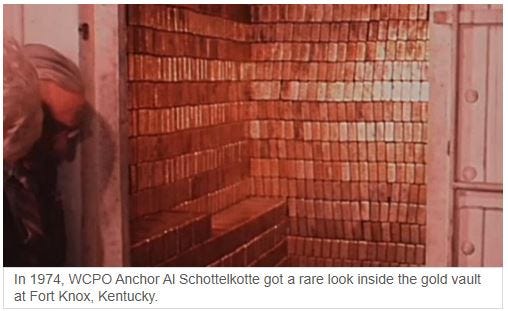

What we do know is that the last 'audit' of America's gold stash was conducted on September 23, 1974, when the U.S. Treasury opened one of its 15 vaults at Fort Knox so politicians and reporters could have a two-hour photo-op with roughly 6% of the amount held.

Unfortunately, none of the bars being passed around for the cameras that day were matched to a serial number, assayed or tested for purity, or even verified as U.S. holdings - as foreign countries have previously stored their gold at Fort Knox as well.

Although Fort Know is the symbol of the U.S. gold inventory, it only holds 56% of the nation’s total. The remainder is held at West Point, Denver, the New York Fed and the various U.S. Mints.

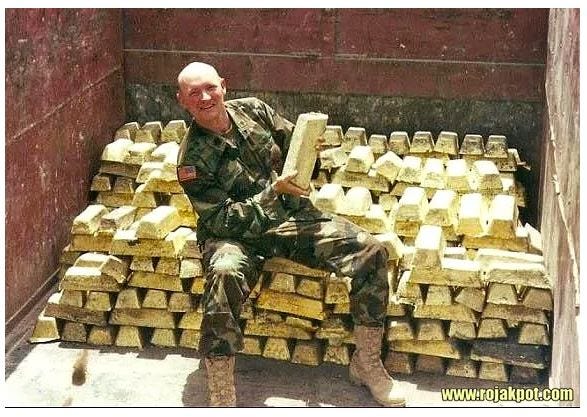

There is also some speculation that gold seized in Iraq (and elsewhere) may be stored there, unbeknownst to the public.

My bet is any audit will be anticlimactic.

SWF

Have you ever been drowning in debt? You take a cash advance from one credit card to pay another or make your mortgage payment? I have. It’s no fun and the stress it puts you under is almost unbearable.

Our national debt is like that now. I was able to work out all my debt problems with hard work and austerity. Austerity meaning no dinners out. Sell a few trinkets. Use debt consolidation intelligently.

But how does the U.S. government get out of its problem? Usually, we hear that there are only two options: 1) raise taxes; or, 2) decrease spending (austerity).

Well last week there was talk about a third option. It’s not a cure-all but it could make an impact.

What’s this miracle option? A sovereign wealth fund (SWF). A what?

According to my new best friend Grok (a free artificial intelligence tool like ChatGPT):

“Sovereign wealth funds are state-owned investment funds or entities that manage a country's surplus wealth, typically derived from commodity exports, foreign exchange reserves, or other national revenues. They are designed to preserve and grow a nation’s financial assets for long-term goals…”

Assets placed in the fund would still be owned by the U.S. government. They would, however, be available to be used as collateral for loans.

So, what would the United States’ SWF look like? The country has many physical assets that could be placed in a fund. But what was mentioned last week was gold.

The U.S. gold reserve held in Fort Knox and the other locations equals approximately 8,133 tons of gold. Given that there are 29,167 troy ounces of gold in a ton, the U.S. reserves equal approximately 237,215,000 ounces of gold. At today’s spot price of $2,933 that’s nearly $700 billion that could fund the SWF.

So why would we do that? The thinking is that the SWF’s assets could be used as collateral for loans at interest rates more favorable than we have to pay on Treasury securities. The Treasury has a large amount of short-term treasury bills and notes coming due shortly. With interest rates at current levels and possibly ticking upward, $700 billion in gold-backed loans could save the country money on interest at no loss of its gold reserves. The proceeds of the gold-backed loans would be used to reduce the national debt.

But who says that the gold should be $2,933 per ounce? In the past the U.S. and other countries kept the price of gold artificially high to stabilize their currency. For example, from the mid-1800s until the early 1900s the official price of gold was $20.67 per ounce. At the time a $20 gold piece contained exactly $20 in gold.

What if we did the same thing today? What if we artificially raised the price of gold to say, $3,500? That would mean the government could borrow $830 billion.

Will any of this happen? Who knows.

Bond, James Bond

In a development that stunned the film industry, Amazon MGM announced Thursday that the studio has taken over the creative reins of the James Bond franchise after decades of family control. Longtime Bond custodians Michael G. Wilson and Barbara Broccoli said they would be stepping back.

Amazon MGM Studios, Wilson and Broccoli formed a new joint venture in which they will co-own James Bond intellectual property rights — but Amazon MGM will have creative control.

So, what does that have anything to do with gold?

Only that the most famous and (in my humble opinion) best of all the 007 movies is…..