In case you hadn’t noticed, we have an inflation problem. Inflation is the hidden tax that saps our incomes and purchasing power, while making it easier for the government to repay its debt with cheaper dollars.

But to listen to our government, you’d never know it.

Per The Federal Reserve, Inflation is transitory. According to Forbes, “Transitory inflation is a term that was widely used in 2021 by Federal Reserve… …officials to describe higher-than-normal prices that emerged during the Covid-19 economic crisis.”

Inflation was 9% three years ago and now it’s down to 3%. According to CNN: “The year-over-year inflation rate in January 2021… …was about 1.4%... …the March 2024 inflation rate, the most recent available rate… …was about 3.5%”

Or, if you can’t make things up, change the goalposts: The Bureau of Labor Statistics (BLS) “Announces Coffee Prices Will No Longer be Factored Into CPI Inflation Data.” The coffee we buy was up over 70%. We wouldn’t want something we buy to distort the CPI, now would we?

Then you have the intelligentsia telling you that there’s nothing to see here: In October 2023, “Nobel economist Paul Krugman gets trolled for saying inflation is over if you just exclude most of what people buy.”

So, the message from “the powers that be” is:

But we know things aren’t fine.

According to the American Institute for Economic Research, “a price index is just a weighted average of prices. People often reference the price index as capturing “the cost of living.” This is the purpose of constructing a price index. Economic theory demonstrates that a measure of the cost of living should track the cost of a basket of goods that provides the consumer with the same level of satisfaction across time. If done properly, this price index not only tracks the average behavior of prices over time, but also tracks the cost of living.

As we saw in the example above, the BLS removed coffee from their CPI statistics, even though it’s a staple in the American household.

A criticism of the current CPI is that it does not consider borrowing costs for mortgages or cars. A new paper by Marijn Bolhuis, Judd Cramer, Karl Schulz, and Larry Summers constructs an alternative version of the CPI that includes “mortgage interest payments, personal interest payments for car loans and other non-housing consumption, and lease prices for vehicles.” What they found is that their alternative measure suggests that the inflation rate peaked at around 18 percent in November 2022 and remained considerably higher at the end of 2023 than the official calculations of CPI would suggest.

In other words, this alternative method is more realistic than the BLS model.

It also shows us that the BLS number greatly underestimates the true rate of inflation.

So, think of the average middle-class family. Their food prices are up, gasoline is up, everything is up. They used to be able to afford going to Red Lobster as a treat, but it’s out of business. Even Cracker Barrel is having issues.

So, where does our middle-class family of four go to dinner for a treat? McDonald’s, Wendy’s, Burger King, Chick-fil-A? These always were affordable places for a low-cost family outing.

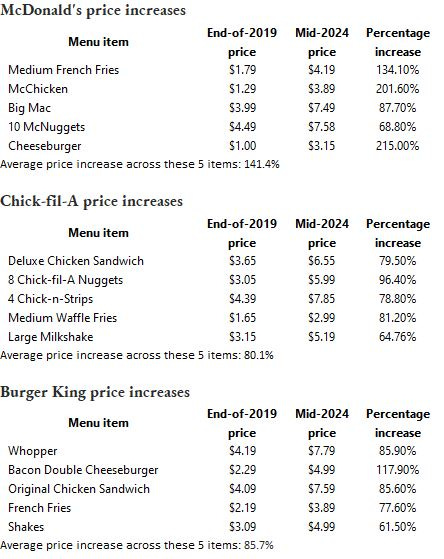

The news there is not so good:

A Big Mac and medium fries will set you back $11.68. That’s before a drink. How about a Whopper, fries and a milkshake? $16.67. That’s $66.68 for a family of four. Is that affordable?

Even the car they’re driving to Burger King is older. According to ABC News: Average US vehicle age hits record 12.6 years. Why? With the average new car costing over $47,000, most people can’t afford a new car. In April 2019 the average car cost $33,695. Not only did the price of a car go up over 7% per year, but between January 2020 and October 2023 the average 60-month car loan rate went from about 4.35% to 7.25%.

And, new cars cost more to insure. According to the BLS, average car insurance rates had already increased by almost 12% as of April 2024, compared with December 2023. That’s in only four months; a 40% annualized rate.

According to an incredibly shocking new study, most Americans do not make enough money to “live comfortably” in the highly inflationary environment that we find ourselves in today. In fact, it takes $177,798 for a family of four to live comfortably in the United States.

But somehow our betters just can’t see it. Last December, Paul Krugman wrote in the New York Times that “surveys of consumer sentiment and political polls continue to show that Americans have a very negative view of the… …economy,” when he feels that those polled are wrong. Nothing to see here, move along.

I guess Mr. Krugman hasn’t purchased Chicken McNuggets at McDonald’s recently.

Seems to me we fought a war about this very thing not so long ago…. I believe the teachers union helped in blinding the sheep when they stopped teaching about it and started influencing young people to tear down statues!