Living at the beach, our real estate market is generally pretty solid. I mean, let’s face it, nearly everyone wants to live near the ocean.

The growth of housing in my home of Sussex County, Delaware is usually pretty robust. Unfortunately, it seems like the land on nearly every country road you drive down is being clear-cut and bulldozed for a new housing development. I say unfortunately because there’s a growing fear that the local infrastructure cannot support the influx of so many new residents.

In general, however, this growth is good for the local economy.

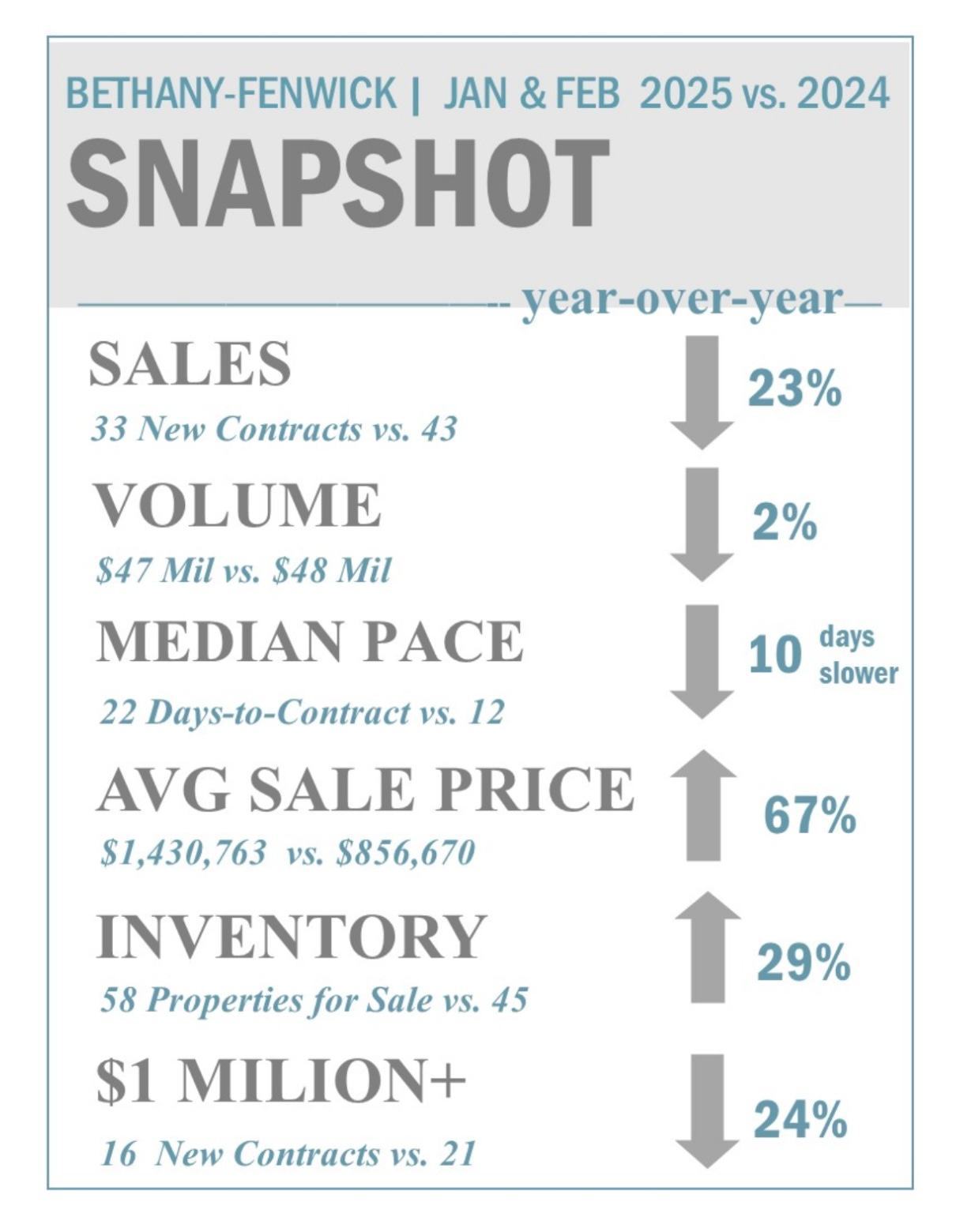

But the news here and around the country is not so rosy. Here’s something a local realtor sends me every couple of months:

This pretty well captures the problems in housing our country faces. Sales are down and take longer to complete. The inventory of homes is increasing and it’s mostly the expensive homes that are selling.

Realtors around the U.S. have been experiencing a surge in delistings. This is on top of a slowdown in home sales and a growing inventory of unsold houses. According to The Wall Street Journal, nearly 73,000 homes were pulled from the market in December 2024. This represents a 64 percent increase over December 2023.

Despite the delistings, the inventory of unsold homes has grown as home sales decline to their lowest level in 30 years.

So, what’s causing this turmoil in real estate? There are several factors, most of which focus on interest rates:

Obviously, mortgage rates are a major factor. For example, a 30 year mortgage payment at 6% is 40% higher than the same payment at 3%. This alone can make housing unaffordable to many buyers.

My friend Grok tells me that: “The historical average interest rate for 30-year fixed-rate mortgages in the United States, based on data from Freddie Mac, is approximately 7.73%. This figure reflects the average from April 1971, when Freddie Mac began tracking rates, through February 2025. Over this period, rates have fluctuated significantly, reaching an all-time high of 18.63% in October 1981 and a record low of 2.65% in January 2021. The long-term average provides a benchmark that shows current rates, which are hovering around 6.76% as of early March 2025, are below the historical norm, despite recent increases from the unusually low rates seen in the early 2020s.”

Sellers are generally unwilling to accept lower prices for their homes. The boom market that accompanied the Covid pandemic, where people were bidding up the price of homes in the suburbs or exurbs just to get away, is over. In fact, many of those purchasers are now looking to relocate to the cities they left just a few years ago, but they want to sell their homes for at least what they paid in a booming market.

Sellers are reluctant to sell based on what’s called “rate lock” – homeowners with historically low interest rates of three and four percent don’t want to give up those low rates for a home at a much higher rate.

All these issues point to the fact that presently housing is not affordable. The following chart (my apologies as it’s hard to read) from the National Association of Realtors graphs the affordability of housing for first time homebuyers. As of the end of 2024 housing is at the most unaffordable point since 1985.

* * *

So how does this get resolved? Well, it’s hard to say but I suspect that the market will slowly resolve itself. Sellers will slowly accept lower prices. Unless interest rates drop significantly, buyers will slowly accept lower-priced and more affordable homes that may not have been as luxurious as they originally desired.

If interest rates stay near their historical level, these changes may not come soon or rapidly.

In other words, a new version of normalcy will exist when both buyers and sellers adapt to the current market conditions.

Hopefully, there will soon be a load of houses for sale in the greater DC area.